The Tyranny of the Status-Quo in Tunisia (*) - August 2015

Brahim Guizani, Ph.D. - Economist

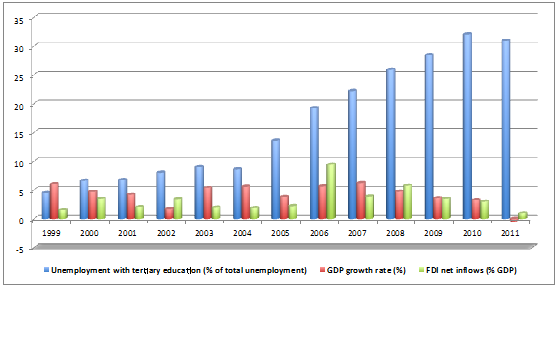

This article will attempt to put the Tunisian economy into perspective trying to point out not only the deep stagnation we are in, but also emphasize the gravity of its lengthy burdenand the tyranny of the economic policies status-quo we are still following in Tunisia. It is pointless, evidently, to keep hoping for a better outcome from longtime failing economic policies in dealing with an unacceptable situation of the Tunisian economy.Four years ago a popular uprisingsurged in Tunisia. This upheaval has uncovered the weaknesses of a seemingly helpless economythat is desperate to create the necessary wealth that can meet the growing society’s needs. These weaknesses that cannot be hidden anymore in a newly established democracy can be summarized in one word;namely the high unemployment rate of Tunisian youth. Thousands of Tunisian households are suffering since a quite longtime from this problem.The less credible official figuresshow that the unemployment ratehas rarely dropped below the 15 percent in the last 15 years. This rate becomes sharper for those who have invested for numerous years in their education. Recent figures tell that the third of the unemployed populationare graduates fromthe university, a figure that does not cease to increase at analarming pace in the last 10 years (see figure below). This cluster of the populationhasfound itselfnot only unable to find jobs that correspond to its dreams and aspirations, for which they have worked hard for long years, but incurring a long-term unemployment, sometimes without realistic hopes. TheJasminerevolution has shown how desperate and hopeless this vital group of the society is. Italso showsthat it has become unacceptable and intolerablethat policymakers keep ignoring and hiding their eyes from this phenomenon anymore. Indeed, it is to find solutions, they were elected for !

Since the relative success of the Structural Adjustment Program (SAP) of the late 80s and early 90s,we can say without exaggeration that mosteconomic policies in Tunisia were permanently failing to create the necessary growth that keeps unemployment rate within reasonable limits. Despite the positive growth rates that sometimes could reach 6 percent, these policiesfailed to transform the economy from low value-added sectors to high value-added sectors, essential to absorb agrowing number of skilledlabor. The economy is obviously bounded by a growth rate ceiling that it cannot surpass; a situation that I would like to call “The Low-Growth Rate Trap”.

Everyone in Tunisia notably policymakersdo agree that policies must change and the development model of the economy should shift to more productive sectors in order to reduce youth unemployment.But the question that nobody is so far able to answer isHow?

Since the late 80s, Tunisia has been mainly following development policies inspired by what is known as the Washington Consensus, a schemeof policy prescriptions that are roughly based on the following three pillars:Fiscal Austerity, Liberalization, and Privatization. These policies that were designed by the IMF’s and the World Bank’seconomists were seen as the best policies to enhance growth rates through improvement of market efficiency.

During the last decades, successive Tunisian governments were clearly following near-austerity policies with the objective of keeping public debts and budget deficits within specific and even dogmaticboundaries; since 1991 the public debt and the budget deficit in Tunisiahave rarely exceeded the levels of55and 3 percent of the GDP,respectively.

After more than twenty years, it is now obvious that the market is not responding sufficiently to the expectations of the government, the IMF/WB and the Tunisian society. Whether through domestic or foreign capital (called FDI as well) the market is not yet responding as expected to the needs of the society. The former is unable to invest sufficiently,limiting itself within the boundaries of the coastal area of the country and the latter isstill not finding our economy sufficiently attractive to invest in highly,productive and value-added projects. Moreover, Tunisia is a small market surrounded by two oil-producing countries that are not very enthusiastic to open their markets to its regionally competitive goods and services. The potentially emerging Sub-Saharan economies are far behind the Sahara Desert, which makes them difficult to reach in advantageous costs by Tunisian exporters.In addition, Advanced Countriesare notadequately transforming their post-revolution warm promises into concrete actions by pushing their firms to invest in Tunisia, leaving us alone facing enormous challenges.

The question to be put into perspectivehere is beyond the debate now occurring in Advanced Economies, which is still turning around the question: Among the Keynesian line and the Free-Market line,what is the best policyto implement in order to boost a sluggish economy. It is also beyond the ideological arguments that are always raised by some politicians against the Bretton Woods institutions (The IMF and the World Bank). For Tunisia, things are much more serious than thatrich countries’debate. The question that is posed to Tunisia is: What are the options left to cope with a war-like situation that has no more reason to continue?Coping with unemployment should be seen as war by the entire nation (sic). Youth unemployment must be regarded asa national problematic rather than a mere government’s task.Tackling this majorsocietal problem needsmassive resources and a sufficient consensusamongmost groups of the society. It is time that the whole nation gets involved in resolving this phenomenon.

It is clear that Tunisia does not have the privilege of choice and unfortunately there is only one option left. Being a one-option possibility makes it necessarily very costly and delicate. A high and persistent juvenile unemployment means literally a society without Hope and Opportunities. And a society that does not provide these two crucial thingsto its youth will likely have to deal withhiddendemons that threaten its very existence. The increasing criminality and Terrorism that Tunisia is suffering from in the recent years are indeed alarming signs.

These facts do not let any option to policymakers but to intervene withmore ambitious and far-reaching strategiesat medium and long termshorizons to boost the economy’s engine that is still rotating at a very low pace. Unlike what they have been used to be, the new approachin economic strategies should be at the image of thehuge policies followed by other countries like theNew Deal of Franklin Roosevelt at the aftermath of the Great Depression or the more recent Abenomics strategies of the Japanese Prime Minister Shinzo Abe. Both leaders have come to the clear idea that it isabsurd to continue with the same failing policies to cope with their distressed economies. They have made the courageous choice of implementing more radical and revolutionary strategies that did not lack bravery and exceptional innovations. I believe that Tunisian policymakers should do the same. Actually, it is timefor a big changeand to quit courageously the tyrannical trap of status quo!

The government should intervene much more significantly to revive the economy. So far it is the only door that is left to knock. However, I should precise that my argument in favor of a further public intervention does not mean that the state should replace the market but this intervention must be in a way that complements what the market has clearly failed to fulfill. By all means, public intervention in the economy must not be in a way that re-create new inefficient public firms thatthe only thing they canappropriately do is wasting taxpayers money and incubatingsome rude trade unions whose job is to protectlow productivity.

Government strategy of intervention must have as principal objective the promotion of productivity.This search for higher productivity must necessarily come from technology and the development of new skills.

This big medium-term strategy must necessarily be based on the two instruments that any government must control; i.e., the fiscal policy and the monetary policy.

Such a mega strategy requires necessarily renouncing the dogmaof the austeritypolicy and substituting it byan important fiscal stimulus for a sufficient period of time. Actually, this is exactly what industrialized economies have done during bad times throughout their history. However, unlike the industrialized world now, the Tunisian government has still plenty of roads, bridges and public infrastructure to build especially in the poor interior regions of the country. The nation’s money should also be invested on technology, education and skills enhancement in order to reinforce people endowment. A special intention to the English language proficiency should be allowed.It is through language that Tunisian educated youth would become attractive to foreign firms who are looking for comparative advantages in our small country.

But to do so, policymakers should first overcome thedogmatic self-imposed budget constraint of the 55 percent of GDP of public debts and go beyond. There is no consensus among economists on the optimal level of public debts. In fact, several countries in the world,such as Japan, could live normally with even a percentage of public debts of 100 percent or more of their GDP.Nevertheless, such a recommendation should not be understood that the door is widely open for recklessness in public finance. Thisdelicate expansionary public spending policy should necessarily be accompanied by structural fiscal reforms that aim to enhance debt sustainability even at relatively highpublic debts levels. These reforms must ensure to the government more permanent budgetinflows. Here, fiscal innovations like what PM Abe is doing in Japan are needed in order to avoida risk of default similar to the recent Greek debt crisis.

Monetary policy should follow as well. There are still rooms to exploit in this areadespite the increasing inflation pressures that it can produce. But first, a cleaning of banks balance sheets from bad assets and improvement of their governance and their capacity to manage risks are required. Monetary policy needs unclogged banking transmission channels to have its expected positive effects.

The government must find incentives for banks to fund young entrepreneurs. These banks still blocked by their archaic and less innovative ways of risk management such as the exclusively collaterals-based lending, are failing the policymakers’expectationsabout fundingprojects by youngsters, who aredecided to count on themselves by their private initiatives.

This extensive public-spending-based strategy must be performed in a very efficient way. It must aim to enhance technology and skills because the current production function of the Tunisian economy is not the one that corresponds to the nation’s needs. The economy must move to a new function and that can happen only through new technologies.

Unemployment is the main disease that is killing the Tunisian society slowly by dangerously eroding Hopeand confidence in the futurefora growing number of generations.This increasing lack of opportunities is alarmingly shapingpeople’smindset especially youngsters. Moreover, the unemployment among educated youngsters is feeding terrorist groups, and the fact that Tunisians are the main nationality among ISIS fighters is clearlydangerous evidence that the society must be aware of.

Accordingly, huge and radical economic policies have to be thought of, and implemented. This task is very delicate,costly and risky as well. For the unemployment problem,it is time that the nation doessomething correspondingly huge. We cannot delay radical decisions no more. This massiveand must-be-firmstimulus strategy needs policymakers who have certain features such as political leadership, bravery, resolve, and efficient governance. It requires the full involvement and the comprehension of the entire nation as well.

Maybe we will have to assume for generations large budget deficit and public debts but it has become inappropriate to tolerate the youth’s deficit of hope any longer. Recall that it took several decades for the USA to reduce its huge public debts accumulated during the post–1929 crash fiscal stimulus.

Policymakers in Tunisia must consider fighting youth unemployment aswar. And in the times of warvast resources should be allocated by the whole nation to beat the enemy.Inertia to change is just a waste of time.

(*) The title is inspired from the book of Milton and Rose Friedman “The Tyranny of the Status Quo”Houghton Mifflin Harcourt; 1st edition (February 27, 1984).